What happens if, at the end of your term life policy, you wish you had life insurance coverage for longer? Or if sometime during your term, you want to buy permanent insurance but either don't want to do another application, or have had a health issue come up?

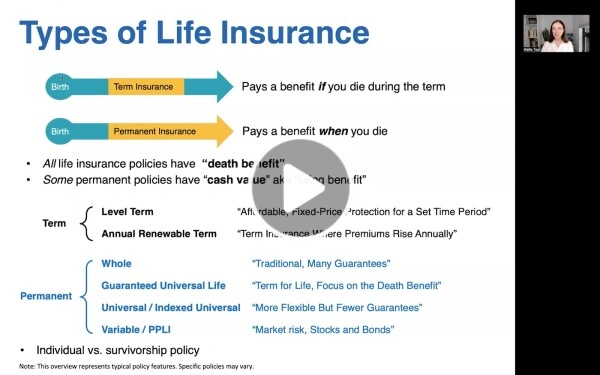

Learn about the advantages and considerations surrounding conversion options, which grant you the right to convert your term policy to a permanent policy at the same price rating you got on your term policy, regardless of your future health.

This video explains how you can use conversion options to give Future You options that you'll want to have, but might not be thinking about today. You'll also learn that all term policies' conversion options are not the same, so if you care about conversion at all, you want to understand how the term conversion on your term policy works.

Want to see your life insurance options? Visit our life insurance calculator for a coverage recommendation or—if you already know what you’re looking for—get an instant online life insurance quote.

To read more about conversion options, check out our blog post, The Option to Convert Your Term Life Insurance to Permanent - A Smart Move or Not Worth It?