Disability insurance coverage is important because illness and injury happen, and when they do, you don't want to compound that stress with financial hardship.

It’s easy to fall into the trap of thinking "it can't happen to me," or to think that disability only happens with freak accidents or dangerous jobs. In fact, nearly 90% of long-term disabilities are caused by illness, and the remainder by injury1.

For me, what really drove home the point that disability includes well-known illnesses that become increasingly common with each decade of life was when five friends in their 30s were diagnosed with cancer over the course of about two years.

My personal experience is not unique -- approximately 1 in 8 long-term disability claims are caused by cancer1, and the risk of having cancer increases with age.

Choosing a disability insurance policy can feel overwhelming. Here at AboveBoard, we focus on making the choices clear, so you can decide what's the best fit for you. This post breaks down the terms you need to know and most important decisions.

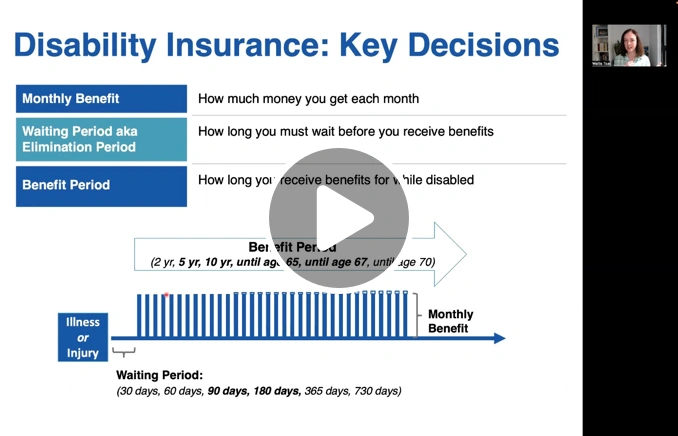

The 5 key items to look at when choosing disability insurance coverage

#1 Monthly benefit

The monthly benefit is how much money the insurance company will pay you each month if you're disabled, meaning you cannot work due to illness or injury.

Your monthly benefit needs to be enough to cover household expenses and save for retirement and other goals, like college savings or a home purchase. With most disabilities, you can expect to make a recovery eventually, but the last thing you want after years of treatment or rehabilitation is to feel like you're now years behind on retirement savings and your dream of retiring is now pushed back.

Keep in mind that when you pay for a policy yourself, the benefit is not taxable—any benefit you choose is free and clear to cover your expenses and build your savings.

The tax-free nature of individual disability policy benefits is the opposite of how workplace coverage usually works. Most (but not all) workplace plans are paid for by your employer. That means that any benefit payments to you would be subject to both personal income tax and payroll tax. Be careful if you have a number in your head about your workplace coverage and think, "great, that should cover my critical expenses"—you might be missing the federal, state, and local taxes you pay on your income.

# 2 Waiting period a.k.a. elimination period

The waiting period (or elimination period) is how long you have to wait to start receiving benefits, starting from the time you are unable to work due to illness or injury.

If you take one thing away from this post, let it be this: don't buy a disability insurance policy with a 30 day or 60 day waiting period. Choosing a 90-day waiting period is usually the best option, but 180-days can be good, too, if you could comfortably fund the first 6 months yourself.

30 or 60 day waiting periods are usually not worth it because they are so much more expensive than policies with 90 day waiting periods.

Typically, the math works out such that if you saved the difference in premium, then sometime within ~3-5 years, you’d be able to fully cover that extra month or two of waiting period IF you experience a disability or for any other emergency that can strike (a job loss, an unexpected major expense, etc.).

For most people, 90 days or 180 days is the right choice for the waiting period. What you'll usually find is that 90 days is not much more expensive than 180 days, and if you end up experiencing a disabling illness or injury, you'll for sure have been better off with the 90 days waiting period.

However, there are several situations where 180 days can make sense:

- Your employer offers very generous short-term disability benefits lasting up to 180 days, and you feel like your career path is likely to keep you at the employer or another employer with similarly generous benefits (typically workplace plans replace 60-67% of your income, with that benefit being taxable to you, and the more generous plans replace 80-100%)

- The difference in price between 90 days and 180 days waiting period appeals to you, and you're comfortable with the idea that if you experience a disabling illness or injury, you'll need to wait ~6 months (an extra 3 months) before receiving benefits

There are also 1 year waiting periods, but the savings on these versus 180 days are usually not that great. While occasionally they can make sense, a year is a long time to wait if you're going through a serious health event or recovering from a traumatic injury. Most disabilities last 2-3 years, so one year is a big portion of most disabilities.

#3 Benefit period

The benefit period of a disability insurance policy is the maximum amount of time that you can receive benefits for, during the time you are disabled.

The choices for benefit period are usually 2 years, 5 years, 10 years, until age 65, until age 67, or until age 70. Like I mentioned above, most disabilities last 2-3 years. Examples would be treatment for cancer, recovering from a heart attack, rehabilitating from a severe car accident or stroke, and many people experience more than one such event in life (a recurrence of cancer, a second cardiac event, etc.).

Some disabilities last much longer than 2-3 years, but a person with the diagnosis can still expect to live for the duration of their working lives. Examples of these types of disabilities would be more severe manifestations of multiple sclerosis, Parkinson's disease, or arthritis.

Particularly in families where there are two income-earning adults with somewhat comparable earnings power and lifestyles modest relative to their means, a 5 year benefit period can be a reasonable way to balance budget and protection goals. The trade-off here is that—if one or both receive a diagnosis that results in more than 5 years of disability—they need to stand ready to make some hard choices, like relocating to a lower cost of living area. For some people that sounds fine; other people like the idea of being able to keep life going as normally as possible without being forced to take on additional drastic changes.

In families where there is one income, one adult earns a disproportionate share of household income, or the family's chosen lifestyle requires both incomes, a policy where the benefit period extends until your target retirement age is usually your best bet.

That said, if you need a disability policy covering until your expected retirement age but simply cannot afford it, something is always better than nothing. If your budget allows you to afford a policy with a 5 year or 2 year benefit period, that is almost always better than zero years -- it gives you and your loved ones some runway to understand your health situation before dealing with the financial issues. And if you do end up facing a disability that would last longer than what is covered by your policy, at least you have some time to prepare.

#4 Own occupation versus any occupation

Own occupation coverage pays you 100% of your monthly benefit if you, due to injury or illness, are unable to work in your occupation, even if you can work in another occupation. I generally recommend that you ask yourself, "are there special physical capabilities required to do my job, where I can reasonably imagine an illness or injury that would make me unable to do my job, but I could do another job?"

If the answer is yes, you probably need an own occupation policy.

Here are examples of jobs where own occupation is the right choice:

- Medical fields: surgeons, dentists, veterinarians, or other doctors who rely on their fine motor skills and/or physical strength to perform their job functions

- Professional fields requiring the physical stamina to maintain a rigorous travel schedule or handle significant stress: attorney at high-pressure/long hours firm, investment banker, trader, private equity investor, corporate executive

If the answer is no, and you feel that if you are too sick or injured to do your job then you are too sick or injured to do any job, then "any occupation" can be a good choice -- just make sure you get residual or partial disability coverage, too.

#5 Residual disability or partial disability

Residual disability or partial disability benefits pay you a portion of your monthly benefit if you are partly, but not totally, disabled. Examples of this would be that you're able to work 2 days/week during cancer treatment, or you're able to work 3 days/week during your physical rehabilitation from a severe car accident.

When you're undergoing a significant health event, it can be emotionally very comforting to be able to work some when you can. A residual or partial disability benefit can help ensure you get "made whole" for the parts for your job you can no longer fulfill.

In general, you should always add residual disability or partial disability, if it is available to you (some occupations are not allowed to have this feature). It is also very helpful if you have an any occupation policy and end up being able to earn less money working in a different job.

Additional features to consider

#1 Future increase option

A future increase option offers you the ability to increase your coverage in the future without having to prove you are still healthy. This can be a very helpful feature because it allows you to ensure that your policy keeps up with your income so long as you're working, even if you encounter health issues in the future.

Importantly, different carriers have different approaches to how they handle this feature. The approaches usually fall into one of two groups:

- Free but requires future action: the policy does not charge you extra, but you generally need to update the carrier on your income every few years (oftentimes every 3 years) and you must accept at least half of any increase you're eligible for, or you lose this feature.

- Paid for but low maintenance: you are not required to do anything unless you decide you want to get increase

#2 Cost of living adjustment a.k.a. cost of living increase ("COLA"/"COLI")

This feature gives you an inflation-based increase in benefits every year that you remain disabled, starting in your second year of disability leave.

This rider can be really valuable if you have a very long-term disability. People who are budget-focused are more inclined to skip this feature.

Sometimes, younger people get COLA and plan to drop it if they are still working, healthy and not disabled by the time they get to the final ~10-15 years of their career.

You can learn more about this rider in Disability Insurance: Cost of Living Adjustment.

#3 Catastrophic disability

A catastrophic disability rider pays you extra if your disability is so severe that you require long-term care.

In general, we advise that the best approach is usually to handle your long-term care coverage separately from your disability coverage -- while it's pretty uncommon to need long-term care before age 65, more than half of us who live to see age 65 end up needing long-term care!

But if you're looking for a "stop gap" to cover LTC needs until you lock in a proper long-term care policy, a catastrophic disability rider can meet that goal.

People who are budget-focused are more inclined to skip this feature.

#4 Non-cancelable versus guaranteed renewable

Non-cancelable means that the insurance company cannot raise the price on you, up until a specified age (usually around age 65).

Many policies are automatically non-cancelable and you do no have a choice. Other companies give you a choice. If you don't choose non-cancelable, you're usually choosing "guaranteed renewable". Guaranteed renewable means that the insurance company must offer you coverage each year up until a specified age (usually around age 65), but they could raise the price.

In general we recommend choosing non-cancelable because it gives you the security of knowing the carrier cannot raise your rates. Additionally, you usually only save around ~8-15% with guaranteed renewable anyway, and that only helps if the carrier even gives you a choice.

An insurance carrier cannot unilaterally decide to increase the cost of your guaranteed renewable disability policy in a given year.

To make a rate increase on their clients, insurance companies must file a request to increase with the state regulator, and the state regulator must approve the increase.

Regulators generally frown upon price increase requests, but they do grant them. As much as regulators dislike price increases, they dislike insurance companies going under on their watch even more. Rate increases can and do happen, but they usually happen when an insurance company realizies they made a mistake pricing their prior business, and their state regulator is getting concerned that the price increase is necessary to keep the insurance company financially strong.

Case studies: different choices make sense for different people

Here are two examples of real-life clients - see how the different coverage options can come together.

Lydia* has worked hard at an NYC Big Investment Bank to build the lifestyle she enjoys today, and she likes knowing she can maintain it in any scenario: car accident or ski injury, cancer diagnosis, severe multiple sclerosis, etc. She's single today, but interested in having children within the next few years, with or without a partner. She decides on a $15,000/month disability income insurance benefit with a 180 day waiting period (workplace benefits are very solid for the first 6 months) and until age 65 benefit period to complement her existing workplace coverage. As an equity research analyst who loves her job but can envision a scenario where the physical demands of travel might not be workable in some scenarios, she chooses an own occupation policy. Since she’s a white collar professional in a field where staying front-of-mind for clients is important, she can envision many scenarios where she might be able to work part-time but not full-time if she were navigating a health crisis of some kind, so she goes for a residual disability feature, too.

Ramesh* makes $175,000/year at his software company, and his wife, Fariha* makes $200,000/year as a marketing professional. Their family lives in the Bay Area and is quite committed to their kids' private school, but otherwise they have pretty simple and inexpensive tastes. They save a decent amount of money each year, and their savings are on very solid ground from when Ramesh sold his prior company. He wouldn’t want to move houses or pull his kids out of private school if, say, a cancer diagnosis left him unable to work for 2 years. But if he had a disability lasting much longer than 5 years, he and his wife would probably want to move back to her hometown of Denver near her parents anyway, and the cost of living would be lower. In that scenario, they are confident the family could be fine on Fariha's income alone. Ramesh decides on a $8,000/month disability income insurance benefit that would begin after he’s been disabled for 90 days and would pay out for a maximum of 5 years. He skips own occupation and goes for any occupation—he loves making software; if he can't do that it's because he can't do any job.

As you can see, there are many combinations of coverage options that can work for your situation and goals. At AboveBoard we pride ourselves on giving you the information to make informed, empowered decisions about your coverage needs. Take our quick assessment to find what’s best for your protection goals and your budget.

*All names and personal details have been changed to protect privacy.

Sources: