Part 1 of 2: Why Gerber Should Stick to Baby Food

Losing a child is quite possibly the worst thing that can happen in life. Insurance that claims to protect against this risk can be emotionally enticing…who doesn’t feel like they’d want “protection” from that?

Apart from such tragedy, we all strive to do our best for our children and set them on a path to success in life.

Gerber Life Grow-Up Plan promises to help on both fronts: provide protection in the event of the unthinkable, and give children a financial head start in life.

Gerber Life has over $45 billion of life insurance in force across more than 3.3 million policies. Enough people asked me what I thought that I decided to take a look in detail, as both a mom and someone who spent over 10 years working long hours reading the financial disclosures of insurance companies, banks, investment firms and the like.

Here’s my quick summary:

I believe strongly that the Gerber Life Grow-Up Plan is a terrible product, one that preys on the hopes and dreams parents and grandparents have for their beloved little ones and – through deceptive marketing and poor consumer disclosure – gobbles up their hard-earned money.

I’m going to cover 2 main points, in 2 separate posts, because there’s a lot to say on each of these:

- How the product works and why it’s a terrible deal (this post)

- The extraordinarily bad and deceptive customer service I experienced from Gerber

Why do products like this spark a special level of outrage in me?

You can watch the Gerber Grow-Up Plan marketing videos yourself, particularly the parent and grandparent testimonials in "Your Wish For Your Child" – it’s heart-wrenching.

These parents and grandparents clearly have every intent of doing what’s best for their cherished little ones, but they’ve been deceived by Gerber’s marketing and poor consumer disclosures. The testimonials show that these customers deeply misunderstand the product they've bought.

I understand why – Gerber does not make it easy to uncover the truth. During my own research, I directly experienced customer service practices from certain Gerber representatives that raise serious questions about whether Gerber systematically deceives consumers.

Please do not feel badly if you already bought this product, it is not your fault that you thought you were helping your beloved little ones.

The Gerber Life Grow-Up Plan: A Quick Overview

For a fixed monthly premium, you get from $5,000 - $50,000 of life insurance coverage on your child. You can apply anytime from when your child is 14 days old to 14 years old.

At age 18, the coverage doubles (so if you initially purchased $30,000, that becomes $60,000).

This initial doubling in coverage at age 18 does not increase the premium, but if your child elects any future increases in coverage, it will be priced at Gerber’s standard adult rates at the time.

The policy has “cash value”, meaning there’s an investment balance that can be accessed. However, know that Gerber will charge you interest to borrow from your own cash value – 8% interest, to be exact.

Why Gerber Grow-Up Plan Life Insurance is Bad

Gerber presents itself as both a good investment AND a well-priced way to guarantee the future insurability of your child. Let's talk about each of those claims.

1) Gerber Grow-Up Plan cash value is a terrible investment

Gerber claims: “Cash value that your child could use for a down payment for a car, college text books or other important events”

Customer testimonial: “You stick pennies in a change jar…stick 'em in a policy!”

Let’s take a look at how this investment really performs, and what my daughter might get if she wanted a “down payment for a car” or money for “college textbooks”.

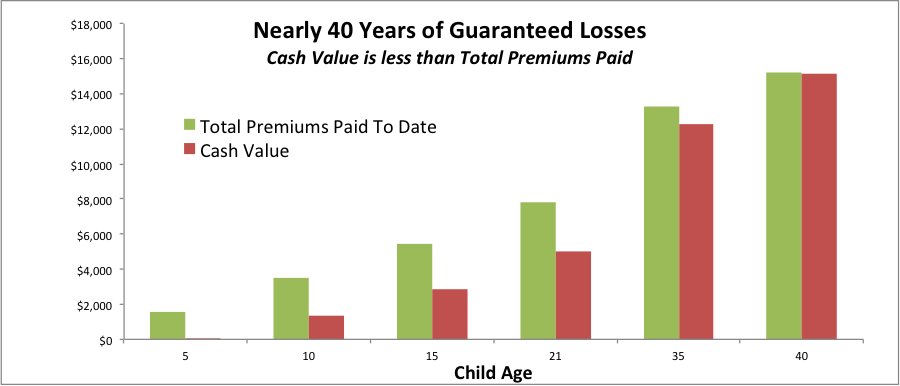

My daughter would get less money than I paid into the policy for every single year from now until she turns 21. In fact, that would hold true until she turns 40 -- that's right, saving diligently for 4 decades just to get back what you put in, zero return on your investment.

That is awful.

I found it so heart-breaking when one of Gerber's featured customers said, “You stick pennies in a change jar…stick'em in a policy!”

This customer clearly doesn’t understand that her child would have had more money for college textbooks or a down payment on a car if she HAD stuck the money in a change jar instead of the Gerber Grow-Up Plan.

Devastating. And shameful that Gerber promotes such misunderstanding.

This chart shows how Gerber’s guaranteed cash value guarantees you a loss on your money if you want access to it anytime in the next few decades.

The difference between the green and red bars is the guaranteed loss of money. That's because the green bar is the money I’d pay in (total premiums paid to date). The red bar is the guaranteed cash value (money we could access through a loan at 8%, or get back if we cancelled).

If my daughter wanted access to take the cash value at age 21, we’d suffer a loss: I’d have paid in $7,824 but she’d only get back $4,991, a loss of $2,833. Sadly, taking this hit and moving on with a more reasonable insurance product and investment plan would still probably be our best option at that point.

And this guaranteed loss is a problem for a long time: if my daughter and I dutifully paid premiums until she reached age 40, we’d still suffer a guaranteed loss with the Gerber Grow-Up Plan cash value.

All that diligent saving, and nothing to show for it in the cash value nearly 40 years later. Awful.

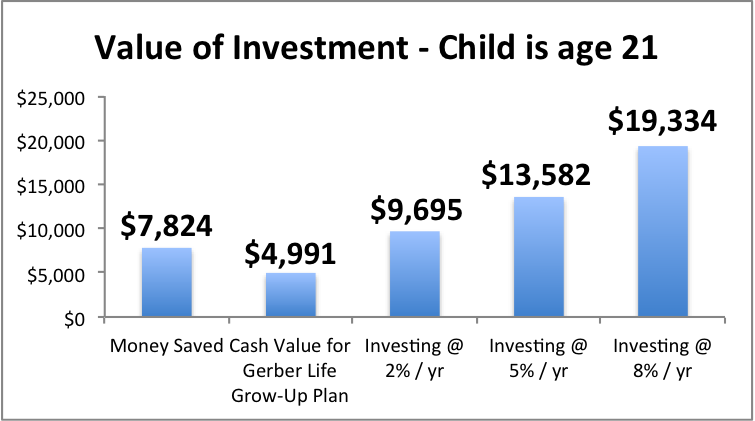

What else could I do with the money, and what might my daughter have available to her at age 21 if I took those alternate paths?

Even if I felt very cautious and wanted to put the money in CDs at a bank, I’d end up with $9,695 for my daughter, assuming a 2% return (in line with current 3 year CD rates, so a pretty modest assumption).

If I invested in a portfolio of equities and fixed income and achieved 5% or 8% annual returns, I could have nearly $14k (at 5%) or nearly $20k (at 8%) by the time my daughter is 21.

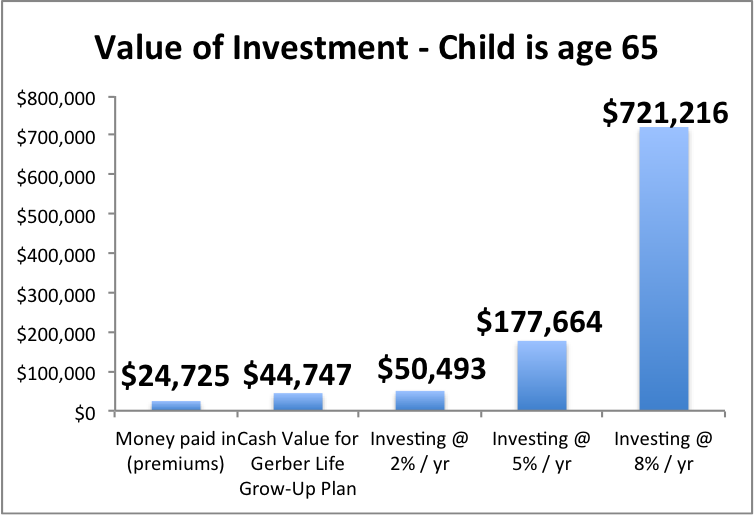

Does Gerber Grow-Up Plan get better over time? Not really. Certainly not enough.

Here’s what it would look like when she’s age 65

The Gerber Grow-Up Plan offers a terribly low return, and the cost of putting our family’s money there instead of in a portfolio of investments appropriate for a longer timeframe is gigantic. Look at how much my daughter could miss out on.

2) Gerber Grow-Up Plan is extremely expensive insurance, and the “guaranteed future insurability” is very unlikely to help your child

Gerber claims: “Guaranteed future insurability!”

Gerber claims: “Lock in a child-sized rate!”

A key “promise” of the Gerber Grow-Up Plan is “guaranteed coverage for life”, but this feature is actually quite restrictive and falls short of its nice-sounding promises.

The welcome letter for my daughter’s policy highlights,

“Total coverage available using guaranteed purchase options: $500,000”

…that’s because I purchased $50,000 as the child coverage amount, and the max is 10x the child coverage amount. (If you bought $20,000, the max would be $200,000.)

You have to read the fine print to see how it actually works -- the whole scheme looks designed to make it tough to get the additional insurance. It feels like a “gotcha!” product.

Gerber doesn’t let your child call or write when they need the additional life insurance and simply get it. Nor does Gerber let your child get whatever they need (up to the max) all at once.

The process for increasing coverage suffers from two problems: restrictive timing and restrictive amounts.

Restrictive timing: there are specific ages when the child may request increased coverage, and that request must happen between 30 days before and 30 days after the anniversary of this policy being purchased...

...So you and your child now have to remember not just birthdays and anniversaries of loved ones, but anniversaries of your insurance purchases for this to work...ridiculous.

An "age-based” request can be used “early” IF your child proves they got married or had a child (by birth or adoption)…but wait, only if they log the request within 90 days! And only if they haven’t increased their insurance 9 months prior to logging that request.

And one more detail: the latest the child could possibly increase coverage is the policy anniversary when they're age 40. So if you hoped your child might have the option to increase their insurance in their own golden years with this child life insurance, that's not possible with Gerber.

Restrictive amounts: even if the child does manage this complicated calendar correctly, they can’t just contact Gerber and say “I see I have max coverage of $x, I need that now, please.” They can only increase in increments equal to the grown-up coverage amount in the policy you bought. That “grown-up coverage amount” is the amount the child has after the coverage doubles at age 18.

So if you buy a policy for $20,000, your child can only get a maximum increase of $40,000 each time they request it as an adult, so long as they managed the complicated timing of the permitted requests correctly.

Sheesh. Talk about Gerber not setting a child up for success.

Now let’s take a look at Gerber’s actual pricing.

Spoiler alert: the Gerber Grow-Up Plan is very expensive life insurance that gobbles up your money and “buys your child the option” to purchase even more expensive life insurance in the future.

I’ll walk you through how it works using my 1 year old daughter's policy as an example.

Gerber would charge me $32.60 / mo (= $391.20 / year) for $50,000 of life insurance coverage for my daughter.

When she’s 18, coverage would double to $100,000 “at no extra charge” as Gerber likes to say.

But is the rate really “child-sized”, which – the marketing implies – we should understand to mean a good price?

Hardly.

Let’s imagine my daughter is a 21 year-old young woman. How might she think about whether she wants to keep paying premiums on the Gerber Life Policy?

To keep the existing $100,000 in insurance going, she’d need to pay $391.20 / year.

Let’s say she’s thinking about whether to keep this policy going, or keep investing and life insurance separate, and buy term insurance.

To get $100,000 of 30 year term life insurance:

A healthy non-smoker 21-year old female would pay $115 / year, $276.20 / year LESS than Gerber.

A smoker who’s not so healthy even relative to other smokers would pay $289 / year, still $102.20 / year LESS than Gerber

You might rightly point out that I’m comparing 30 year term to permanent life, so it’s not apples-to-apples.

But almost no one needs permanent life insurance (though for some people, it is a good choice, just not a Gerber policy, most likely). And we’ve already established in #1 that this is a terrible product from an investment perspective, so why lock your child into paying extra for a terrible investment product?

What if my daughter, at age 21, wanted to double coverage, using the guaranteed purchase option? Gerber’s standard adult insurance rates would apply. To give you an idea of what that might cost, here is the current rate for a 21 year old female non-smoker in New York:

$744 / year for $100,000 whole life coverage

To have just $200,000 of coverage, the total bill to my then-21 year old daughter could reasonably be expected to run around $1,135.20 / year ($94.60 / month).

What are the odds that this whole life insurance will be the best use of your child’s money when they’re a young adult? Incredibly low. I’d estimate very close to zero.

Even if these rates from Gerber were somehow competitive vs. other options, Gerber’s max coverage is unlikely to be enough for your child anyway. Most working adults need at least 10x their annual income in insurance coverage, oftentimes more.

By the time your child is a working adult, the max coverage amount will be worth even less because of inflation. The odds that this expensive policy will offer adequate coverage are therefore quite low.

The Real Risk with Gerber Grow-Up Plan

I believe the biggest risk is that parents and grandparents get lured into a Gerber Grow-Up Plan not fully understanding how the policy is priced and how it will work in the future.

One conversation I had with a rep was telling. She asked me why I wanted to know the cash values at the ages when my daughter would have the option to buy more insurance. (The standard disclosure omits cash values from policy year 21- age 64.)

The agent noted she’d been working at Gerber for nearly 4 years and no one had ever asked.

I explained that I wanted to understand the choices my daughter would have in the future if I kept paying into this policy.

The agent replied, “interesting, usually people just pay us their premiums, then call to ask what the cash value is when it’s time.”

Sadly, by then many customers will have already unknowingly set themselves up for an unpleasant choice: lose money today, or continue to miss out on money in the future.

So What’s a Parent (or Grandparent) to Do...?

It’s wonderful that you want to give your little one a financial head start in life.

But whole life insurance for a child is generally not a good idea, unless there’s a specific, identifiable health history issue that a reputable insurance professional agrees would make obtaining coverage as an adult very difficult…this would be very, very rare.

If you don’t feel comfortable “self-insuring” the risk of the unthinkable (being able to afford final expenses, unpaid time off you might want to take, etc.), then adding a term life insurance child rider to your own term life insurance policy could be a good fit for your goals and budget.

...Do you want clear, unbiased info about life insurance?

Our AboveBoard Interactive Life Insurance Guide offers clear, unbiased guidance on coverage amount and different types of life insurance.

...Do you want to give your little ones a financial head start, but would like some help thinking about the possibilities?

Consider the ways you could achieve this goal broadly - you might be surprised by the options available to you.

The AboveBoard Financial Action Plan is a free, interactive educational tool to help you think through your options. Your instincts to help your little one are wonderful, now channel them in the right direction!