If you're looking for plainspoken advice on how to get the best price on life insurance, I recommend reading this (if you haven't already).

But if you're interested in a slightly more technical description of how pricing works in the life insurance industry, you're in the right place!

Every life insurance carrier has a list of different levels of pricing. While the exact naming of these levels can vary by carrier, the general idea is that there's Standard pricing, a few levels that are less expensive than Standard, and a lot of levels that are more expensive than Standard.

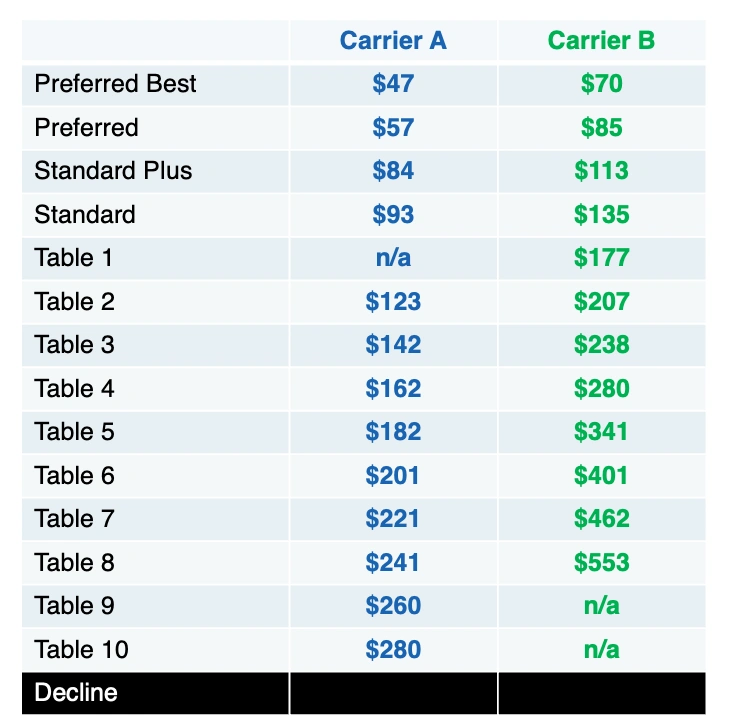

Here's one example of what that looks like (for $1m of 30 year term for a 33 year-old female):

You might notice that the names don't tell the whole story - Table 2 with Carrier A is less expensive than Standard with Carrier B.

How Life Insurance Pricing Gets Decided

When you apply to an insurance company (aka “carrier”) it assigns you a rating - often called a “health class rating” or "underwriting class". This rating drives your premium pricing.

That health class rating picks up your medical history, as well as factors unrelated to your health, such as your driving history and any riskier hobbies.

Your underwriting class is about more than just your health.

The price of a given policy will depend on:

- Your underwriting class (aka health class rating)

- Coverage amount

- Product type (e.g. 20 year vs 30 year term*)

- Insurance carrier (aka insurance company)

- Your age

- Your gender at birth

- Your state of residence

*Pricing of more complex permanent policies is outside the scope of this post.

Once the seven factors above are decided, a price is set by state law.

Why is that? Insurance regulation. All carriers doing business in a given state must file premium pricing with the state regulator. It is illegal for any insurance policies to be sold at prices different from what was filed with the state regulator.

That means that if you work with Brokerage ABC or Brokerage XYZ or go directly to Insurance Carrier Q, the price of a given policy from Carrier Q in that state will be the same, regardless of where you buy it.

Life Insurance Underwriting Class (aka Health Rating Class) Names

Different carriers have different names for their rating classes, but most of them follow this or similar language:

For non-smokers (if you quit smoking / use of nicotine more than a year ago, you are considered a non-smoker!):

Preferred Best (least expensive)

- Clear health profile: BMI, blood pressure, cholesterol are all excellent, never smoked or quit smoking 5+ years ago (some carriers are ok with 3+ years ago), no family history of death from severe illness before age 60, no significant health issues, good driving record, no risky hobbies

- Some carriers permit mild health or lifestyle factors (e.g. mild anxiety)

- No personal history of major illness, such as cancer

Preferred

- Health profile still very good, but there’s a little more “room” on the factors above (i.e. BMI, blood pressure & cholesterol can be a bit higher)

- Never smoked or quit smoking 3+ years ago (some carriers will consider sooner)

- Some carriers permit a personal history of selected significant health events

Standard Plus

- Health profile still good, but there’s even more “room” on the factors above

- Never smoked or quit smoking 1+ year ago

- Some carriers don’t have this category because they only have two premium class ratings better than Standard

Standard

- Health profile still good, but the person does not qualify for the better ratings (maybe BMI or cholesterol is a bit higher)

Table Ratings

- A table rating is a percentage surcharge to Standard ratings

- A table rating is often associated with people who have significant health factors themselves, or a recent health event (e.g. major depressive disorder, personal history of cancer that has been resolved, recent hospitalization for a serious health matter, etc.)

- Table ratings are also used for people who are generally healthy, but simply exceed requirements for Standard pricing in some way (e.g. BMI is higher than Standard, to a degree that cannot be offset by healthy lifestyle credits)

For smokers:

Preferred

- Currently smoke / use nicotine or quit less than 1 year ago

- But for smoking / nicotine use, you’d qualify for a Preferred Best or Preferred rating above

Standard

- Currently smoke / use nicotine or quit less than 1 year ago

- But for smoking / nicotine use, you’d qualify for a Standard Rating above (Standard Plus may get rounded “up” to Preferred or “down” to Standard)

Table Ratings

- Table ratings are available to people who smoke / use nicotine as well. Just like for non-smokers, they represent an additional charge compared to Standard rates

Some insurance carriers use the terms above, others are slightly different (e.g. "Preferred Plus" instead of "Preferred Best" for their best rating), and a few opt for "very confusing" (e.g. call their 2nd-best rate "Elite" instead of "Preferred" and calling their 3rd-best "Preferred" instead of "Standard Plus" - I'm looking at you, Brighthouse).

If you don’t understand where a rating class you’re considering falls, you can either ask us to explain it or say “how many notches different from Standard pricing is that rating class”? You can also ask “if my policy were priced at Standard, what would it cost?” to find out the dollar amount difference.

Remember that what really matters is the price, so don't get overly focused on the rating's name. (Sometimes, you'll see that one carrier's Preferred is actually less expensive than another carrier's Preferred Best.)

How to Get the Best Deal on Life Insurance

There are a lot of things you can do to get the best deal for yourself on life insurance - I go into detail here, in How To Get The Best Deal on Life Insurance and Avoid Getting Hosed.

Ready to get a personalized quote from AboveBoard? Visit our Life Insurance Guide to compare quotes from 20+ highly rated insurance carriers.