“Laddering” life insurance means you buy two or more life insurance policies that last different amounts of time. The goal of laddering is to save money by planning for decreasing life insurance coverage over time.

For example, you might buy $3 million of 20 year and $2 of 30 year term, to give you $5 million of coverage for the first 20 years, then $2 million of coverage from years 21-30.

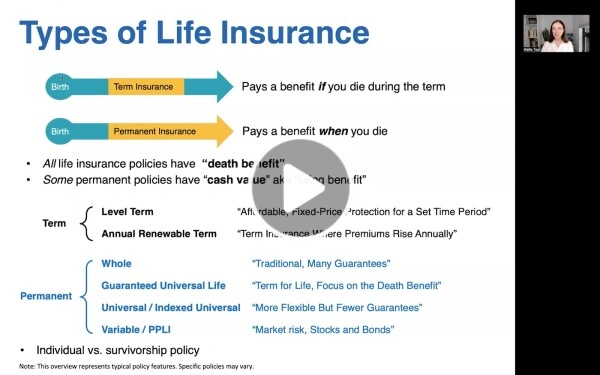

Or your might buy $500,000 of permanent insurance with $3 million of 30 year term.

Either of these strategies is a "ladder".

It can make sense to ladder your life insurance policies when you expect the amount of insurance you need will decline over time.

For many people, insurance needs decline over time. You should start by buying the amount of life insurance you would need if you were gone tomorrow. Then each year that you live and work is one less year you need to insure. If you’re paying down debt and saving each year, your growing net worth can reduce your insurance need if your lifestyle remains steady.

Laddering Life Insurance: How You Could Save Money on Life Insurance

Sometimes, laddering can save money because you're choosing not to carry as much life insurance coverage.

Additionally, laddering means less insurance in your older years, which are the more expensive years to insure. (Life insurance is more expensive in older years because the odds of a person dying go up with age.)

Laddering Life Insurance: Two Things to Look Out For

1) Your insurance need does not decrease over time

For some people, their income will increase and their lifestyle will expand alongside their increased means. In that case, planning to reduce life insurance coverage over time would not make sense.

Remember that your life insurance does not increase with inflation. $2,000,000 in today's dollars will "feel like" ~$1,350,000 in 20 years, if inflation averages around 2% (pretty low). Keep that in mind if you're deciding to ladder, when thinking about your future needs.

2) The premiums you’d save are not that much money compared to the coverage you’d give up OR it actually costs more

Be particularly careful if you’re considering total life insurance coverage of $2mm or less - you might find that laddering doesn’t save you enough money to be worth it, and it can sometimes cost more to ladder.

For people who are under 40 and in very good health, the savings are often not that great, especially on coverage amounts $2 million and less.

If you are unsure about laddering, ask your AboveBoard team about whether the insurance carriers you are considering allow you to reduce the death benefit in the future. Many carriers allow this but not all of them, and they have different rules. Sometimes, people decide they are happier starting with the full amount for a longer period of time, and then deciding later if they want to reduce.

For example, a 36 year old dad of two young kids might decide that he would rather see see how the next ~10 years of health info and retirement savings develop for him, before deciding if he really wants less coverage. If his standard age 45 preventive colonoscopy turns up cancerous polyps, he might decide he would rather carry the insurance for longer. Or if he has several years of high compensation and remains in excellent health, he might decide he is ready for less income replacement coverage, but from a place of confidence and certainty.

Whether or not laddering makes sense depends on the specifics of your situation -- once you know how much coverage you need, we can explain the numbers to see if laddering makes sense for you.

Want a magical tool to help you figure out life insurance? Our interactive Life Insurance Guide asks you a few short questions to calculate your coverage amount and suggested term.