If you're a high-earning professional, disability insurance should be a key consideration in your financial planning.

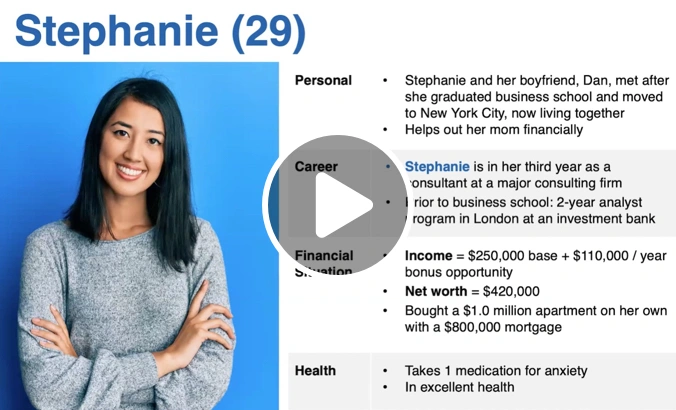

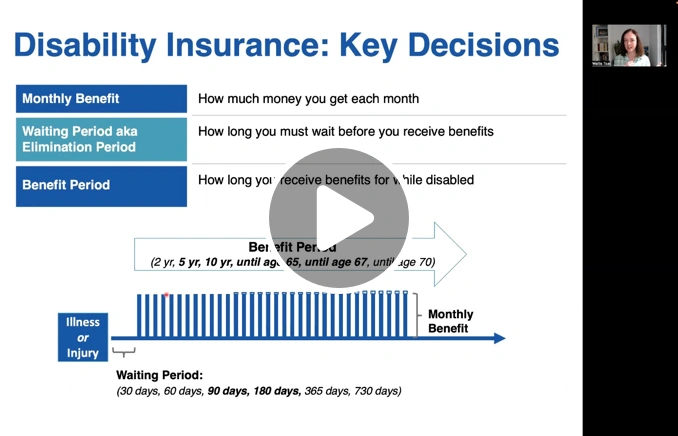

In this series of short videos, we'll follow the story of Stephanie, a 29-year old consultant who makes $360,000 a year. You'll learn why Stephanie's workplace disability insurance isn't enough, why she should get something in place while she is still young and healthy, and how she chooses a policy that meets her goals.

Stephanie's Story:

Meet Stephanie, a high-earning young professional who came to AboveBoard with a greater awareness of potential risks to her financial security related to her own health and wellness.

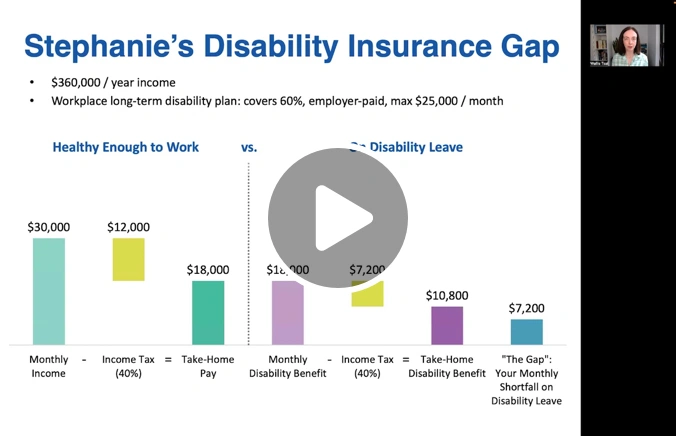

Learn why relying solely on workplace disability insurance would leave Stephanie with a large gap in income if she were to go on disability leave.

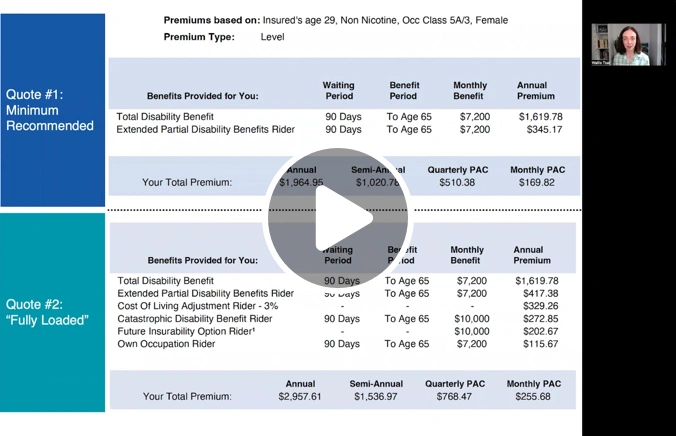

If you're busy and want to quickly get a disability insurance policy in place, this video is for you. Wallis shares Stephanie's minimum recommended quote and how she can decide on additional features later.

Dive deeper into the details and weigh the cost and benefit of additional features with this detailed walkthrough.

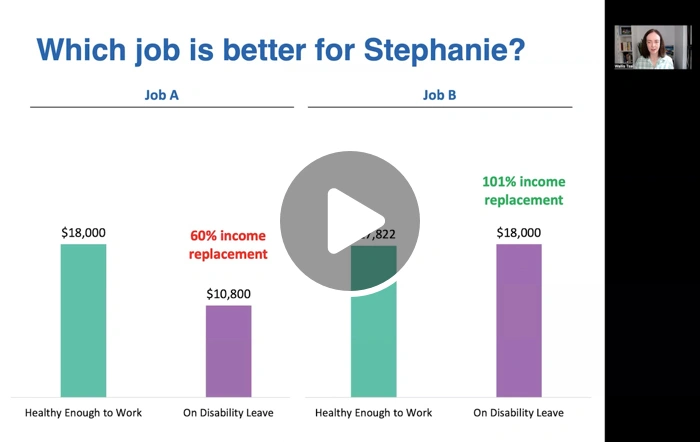

In this video, Wallis uses a simple analogy to show why it's worth it for Stephanie to pay for supplemental disability insurance.

Waiting means higher costs and increased risk of exclusions. Learn why it's better for Stephanie to lock in coverage while she's young and healthy.

Want to explore your options for disability insurance? Get a quote with our quick online questionnaire and experience our unique approach to putting clients' best interests first.