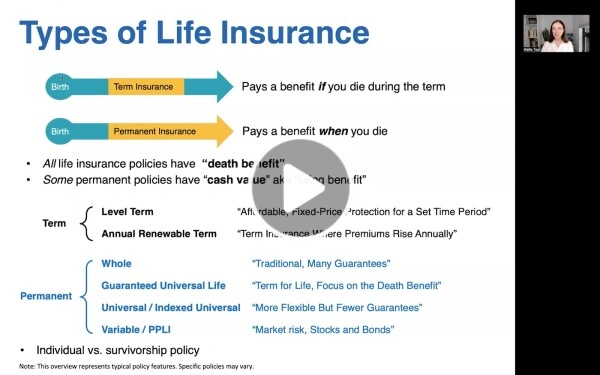

Term insurance is a type of life insurance that is designed to be temporary.

Term insurance is the right choice for most people because it’s:

Inexpensive - term is the least expensive way to replace income if you die prematurely

Flexible - you can easily cancel term insurance at any time: just stop paying and the policy will expire, penalty-free

Simple - it separates investing and life insurance and makes finding a policy faster and easier

Term insurance is the cheapest, easiest way for people to get the amount of insurance coverage they need to insure the risk of premature death. As a result, term insurance maximizes the cash they have available for other goals, like debt pay down or a home purchase.

Permanent insurance is the opposite of term insurance. Permanent insurance is designed to last your entire life. Permanent insurance is a category that includes different types of life insurance, such as “whole life”, “universal life” and “variable life”.

Even if you are someone for whom permanent insurance could be a smart move (the typical prerequisite is a person on firm financial footing who has no high cost debt), if you also need to address the risk that you die prematurely and leave people who depend on you in a difficult spot, then your best approach will likely include a combination of term and permanent insurance.

Here at AboveBoard, we offer smart and ethical advice and independent brokerage services for term insurance and permanent insurance.

To get started exploring your life insurance options, get a life insurance quote.

To learn more about the different types of life insurance, check out these brief videos: