Choosing an investment is an important decision - you want your money to work for you in the best way possible.

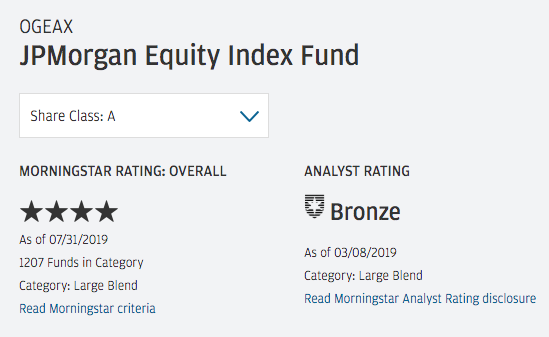

Unfortunately, the systems intended to help people do not always work well. One example of that is Morningstar ratings. Let's take a look at this “Bronze”-rated S&P 500 index fund from JPMorgan, with a stated investment objective of, "Seeks to track the performance of the S&P 500 Index".

It carries an annual net expense ratio of 0.45%...

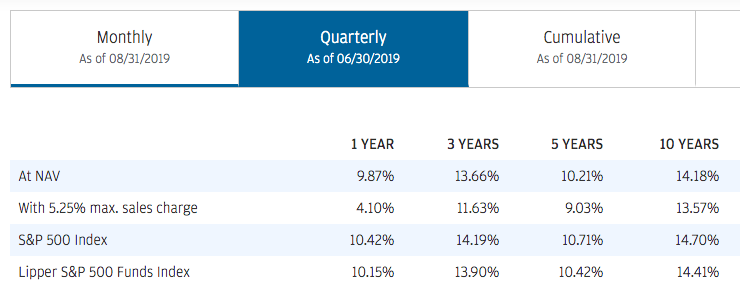

...and an upfront sales charge of up to 5.25%! (That means that every time you invest, they take up to 5.25% of your initial investment; discounts on that 5.25% can be available if you have higher asset balances.)

And note that big gap between performance and the S&P 500 index.

Yikes.

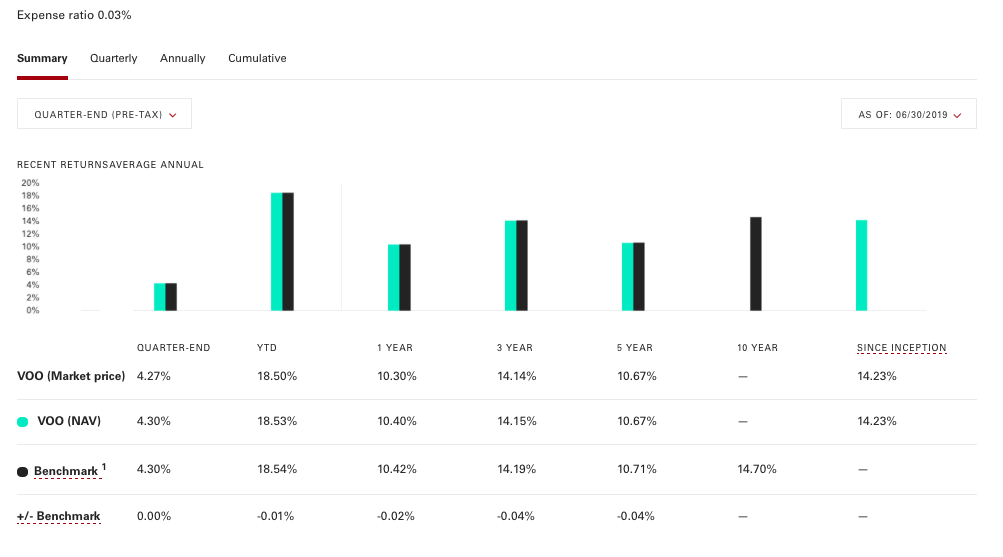

Contrast that with Vanguard’s S&P 500 index ETF, with a 0.03% expense ratio and zero upfront sales charge - look at that low expense ratio, that net investment return so close to the actual S&P 500%. (And no sales charge whatsoever.)

Excellent.

Here we have two ways to invest in the S&P 500, but wildly different fee structures.

By any reasonable analysis, if you’re looking for S&P 500 exposure, the Vanguard fund is a “YES”, the JPMorgan fund is “NO”.

Using Morningstar’s own rating scale (Gold, Silver, Bronze, Neutral, Negative), that “NO” should translate to “Negative”.

And yet, somehow Morningstar’s rating system produces a rating of “Bronze” for that high-fee S&P 500 JPMorgan index fund:

Definitely not the right answer.

How We Approach Investing Decisions at AboveBoard

Here at AboveBoard, we look through to the underlying facts and we run the math.

When looking at the types of insurance where you chose funds (i.e. variable insurance policies), we apply a high level of analytical rigor to give you smart and ethical advice about your options.

We are not against active management per se, but we like reasonable fees for what you get. (High fees for large, passive indices like the S&P 500 fund noted above would definitely not be recommended!)

Ready to explore your life insurance options? Get a quote or send us a message.