Federal law changed in late 2017 to make it OK to use 529 plan money for up to $10,000 / year of K-12 expenses per child. That meant you could withdraw money from a 529 plan and pay no Federal taxes or penalties when using it as part of that new $10,000 annual allowance per child for K-12 expenses.

But if you're a New York taxpayer, you might get take an unexpected tax hit on your state taxes (and NYC*, if you're an NYC taxpayer, too):

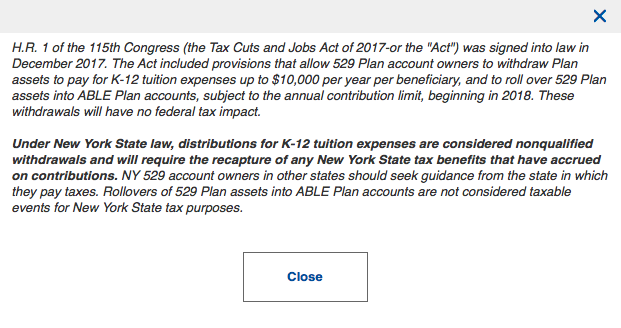

New York state has taken a different approach from the Federal government, and determined that withdrawals from your NY 529 plan will NOT be considered qualified withdrawals for New York state taxes when used on K-12 expenses.

What That Means for You

If you withdraw money from your NY 529 plan for K-12 expenses, you'll have to:

1) "Give back" the associated tax deduction you took on your New York State (and likely NYC)* tax return

2) Pay NY state (and likely NYC*) income tax on any gains you had on the money while it was in the 529 plan*

*A word on NYC: while we were unable to obtain definitive confirmation that New York City Dept. of Finance on plans to handle it the same way, we assume they will, as NYC generally follows New York State on tax treatment of NY 529 plans. (The helpful folks at NY Saves - NY's Direct-Sold 529 Plan - indicated this as well.)

If you already have a NY 529 plan with NY Saves, you may see the pop-up notice below when you log in. The fact they've added this makes me wonder if people are being caught unaware.

It's possible that using NY 529 plan money for K-12 might still be your best available option, but make sure you understand the associated tax impacts before withdrawing funds.

It's best to consult a qualified tax advisor who is knowledgeable of your specific situation.

Please note that this piece is for educational general purposes and is not tax advice. It's always best to consult a qualified tax professional about your situation.

Make sure your dreams for education goals cannot be derailed

Earning income is essential to stay on track for your college savings goals.

Do you have the life insurance and disability insurance you need to ensure your family's dreams would not be derailed if you died prematurely or became too ill or injured to work?

Get a life insurance quote or a disability insurance quote to ensure that a health crisis would not become a financial crisis.