Here at AboveBoard, we are an independent insurance brokerage for life, disability and long-term care policies. We do things differently, placing client's best interests first and doing analytically sophisticated, intellectually honest analysis of insurance. This post is about how I think about investing in my own life.

When my son was born I went shopping for 529 plans offered in my home state, New York, and was shocked by what I found.

I spent over 10 years as an investment banker and hedge fund investor at Goldman Sachs. Spreadsheets and financial disclosures are practically my natural habitat. A full understanding of many plans can require reading (and understanding) a 100+ page disclosure booklet. I happen to be passionate about transparency and fairness in financial services, so I decided to dive into the details, and share my analysis with you.

An Overview of 529 Plans

529 plans can be a great way to save for post-secondary education, which can include grad school or trade school, not just college. 2017 legislation added the ability to use 529 plan money for up to $10,000 / year on K-12 tuition. With 529 plans, the money you (or loved ones) contribute grows free from federal taxes (and almost always free from state taxes) when used for educational expenses the IRS permits. The IRS lays out these permissible expenses in detail, and they include the vast majority of expenses students typically have.

Each state offers their own plan(s), and while you’re permitted to open a 529 plan in any state, some states offer tax incentives, matching grants and/or financial aid advantages at your state’s schools when you open one in your home state. You need to know the tax laws that apply to you and consider the fees and potential performance of different plans before you choose a plan.

New York 529 Plans

For many New York residents opening a 529 plan, a New York plan is attractive because you receive a generous state tax deduction for contributions to New York 529 plans (up to $10,000/year on New York State and New York City taxes for couples married filing jointly, or up to $5,000/year for solo filers). Source

There are two New York State 529 plans:

1) New York’s Advisor-Guided 529 College Saving Program (Advisor-Sold, affiliated with JPMorgan)

2) New York’s Direct 529 College Saving Program (Direct-Sold, affiliated with Vanguard)

The JPMorgan New York 529 Plan

At the time I was shopping for a 529 plan myself, the New York Advisor-Guided 529 Plan has $7.5 billion in assets. A lot of children and their loved ones saving for college are affected by rates charged by the plan.

What’s wrong with it?

In a word: fees. JPMorgan’s fees are much higher than Vanguard’s fees.

(The fees I note below were accurate at the time I was looking, and while fees generally come down some over time, the comparison remains directionally accurate, and is a helpful guide in thinking through "what to look for" when you do similar analysis yourself.)

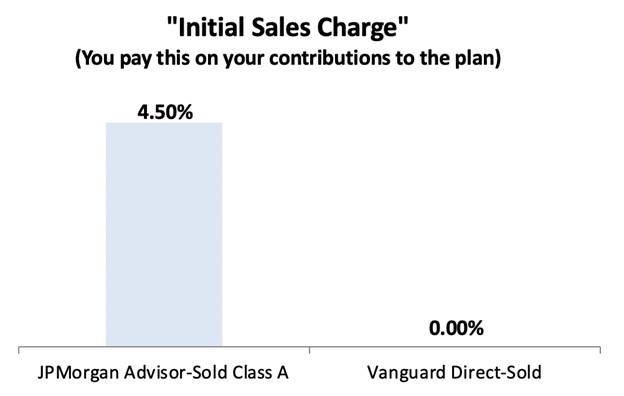

First, you pay an “initial sales charge” with JPMorgan. This is a fee (4.50%) that you pay on the money you contribute to the plan. For example, say you contribute $10,000. JPMorgan keeps $450 for itself and passes $9,550 along to your child's 529 plan. Whereas the Vanguard Direct-Sold policy does not have this charge.

Do not be impressed if your advisor tells you your initial sales charge is something less than 4.50% (the fee begins to decline once you get above $50k or $100k of assets). That is still not OK.

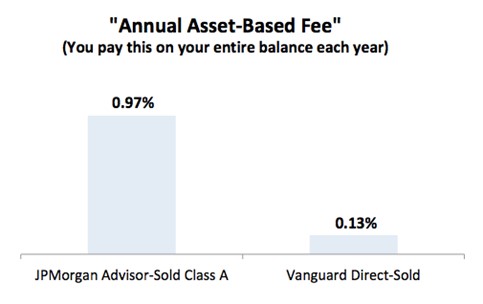

Second, you'll also pay an annual asset-based fee. This is a percentage (0.97%) that you pay on your entire balance every year. Whereas the Vanguard Direct-Sold policy has a much lower fee.

Note: JPMorgan fees of 0.97% are a weighted average, assuming you selected the age-based portfolios (starting at 0.99% for ages 0-5 years, ending at 0.84% for 18+). Vanguard has a flat fee of 0.13%, regardless of what you choose.

Impact of fees over time

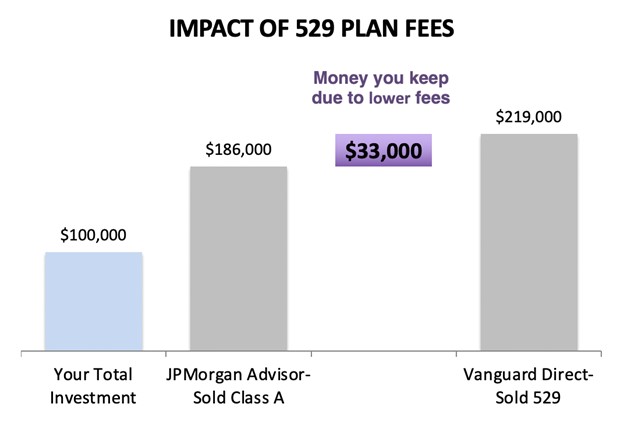

There’s a big difference in fees between the two plans, which will have a huge impact on your kids' college savings.

Let’s look at an example over the course of 18 years. Assume you contribute $10,000 to a NY 529 plan each year for 10 years (for a total contribution of $100,000). Let’s assume the investment performance before fees is 6%/year (the same for both plans). You would end up with an extra $33,000 in the Vanguard Direct-Sold 529 Plan by Vanguard. There’s a lot you and your child could do with $33,000. JPMorgan siphons off an extra 28% of your gains.

Does performance vary between the two plans?

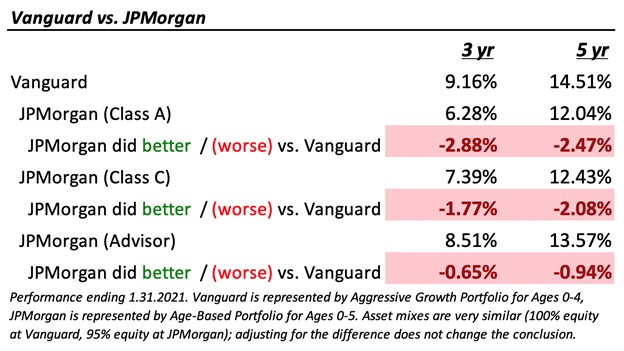

The JPMorgan funds would need to perform much better than the Vanguard funds in order to make up for the higher expenses. Specifically, the JPMorgan Plan would have to return an extra 0.84% (the difference in Annual Asset-Based Fees: 0.97% - 0.13% = 0.84%) each year AND make up for the cost of the initial sales charge (as high as 4.50%).

Over 18 years, you'd need the JPMorgan plan to return about 1.25% more each year to break even with Vanguard. That might not sound like a lot, but it is a high bar–and rarely achieved—in investment performance.

I took a look at all 18 actively managed funds in JPMorgan’s 529 plan investment choices and only a few could make this claim.

Enthusiastic investment management professionals will want to highlight these bright spots in performance history, but it's important to stay focused on what matters: overall performance of a diversified portfolio over time.

When you test any of the age-based portfolios for performance of 1.25% over index, none of them pass the test. And remember that's just the hurdle to break even compared to Vanguard. Sustained 1.25% outperformance is a big bet, an unlikely bet. It sure doesn’t sound like a bet I’m willing to take with my child’s college savings.

This table shows JPMorgan has performed worse than Vanguard during the past 3 years and 5 years. We cannot look at 10 year performance because JPMorgan hasn’t been offering the plan for that long.

What you can do to protect your kids’ college savings

Knowledge is power, so you’re well on your way.

You’ve taken the time to research the best 529 plan for your child, making a smart choice to maximize savings and minimize fees. But even the best savings strategy depends on one key factor—your ability to keep contributing. What if an illness, injury, or even premature death prevented you from providing for your family?

Life and disability insurance help ensure that your financial plans stay on track, even when life takes an unexpected turn.

Get a life insurance quote or a disability insurance quote to ensure that a health crisis would not become a financial crisis.