Every year, countless Americans put renewed focus on health and wellness. Here are the most common questions we get about weight loss and life insurance:

Can I save money if I lose weight?

It depends on what your weight is relative to your height (often measured as your "BMI" or "body-mass index") prior to weight loss.

We work with many clients who have a personal fitness goal, such as “I’d like to get back to my weight before the baby,” but if their BMI before weight loss already qualifies for the best tier of pricing, then further weight loss will not help.

Other times, clients’ weight loss would affect their life insurance pricing, and we help match them with the best carrier for their personal profile at this time.

Importantly, getting life insurance as soon as you need it - even if you are at a weight that increases your life insurance pricing - is always the smart move.

Locking in life insurance coverage ensures you cannot do worse on your life insurance pricing, but it does not prevent you from potentially improving your pricing in the future, if you do lose weight and keep it off.

How important is my weight for life insurance?

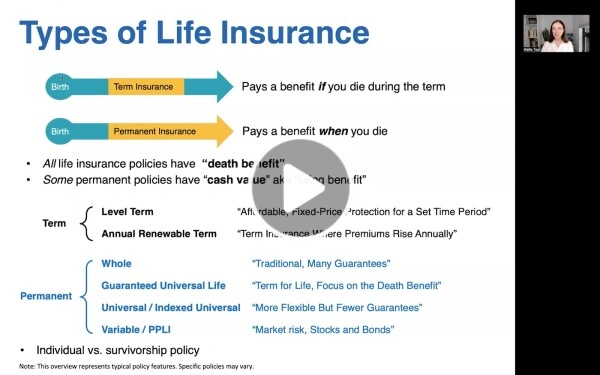

The pricing of your life insurance depends on many factors, and one of them is your weight relative to your height. Most life insurance companies have what they call “build tables” that set weight limits for different pricing levels at different heights. Here’s an example of an actual build table (also called “build charts” or “weight tables”):

This example is just one life insurance carrier, and different carriers have different ideas about what is a “healthy weight” for each height.

Some carriers are more open to the idea that healthy people come in a wide range of sizes. Some even offer programs for “credits” that can help someone get a better price rating than what their build would indicate. For example, your weight might indicate a surcharge to Standard pricing, but with good blood pressure, cholesterol, lab results, and annual physicals plus documented exercise habits, you could get upgraded.

If you have a heavy build because you are a hardcore athlete with awesome muscle mass, there are carriers that will “give you credit” for that as well.

Other carriers are more like the annoying relative who always has something to say about your weight at family reunions. As with the annoying relative, sometimes it’s just best to ignore them!

Why does my weight matter for life insurance?

Life insurance is priced by actuaries who love statistics. They look at data about how, on average, having a build heavier than certain levels is correlated with increased health risks, and they decide they need to charge more for people with heavier builds. As noted above, some carriers have more flexibility than others.

I’m overweight—can I still get life insurance?

Most likely, yes. Let’s use the build table above as an example. For someone who is 5’9”, that carrier will consider offering their Best pricing for someone who weighs up to 190 pounds, and there are a range of options for 5’9” individuals up to 326 pounds.

Remember that’s just one carrier of the over 20 carriers we work with—others are open to higher weights.

For clients whose build is currently above the level where any carrier would offer coverage, we have access to group programs that have been a fantastic solution for our clients who do not currently qualify for coverage in the individual life insurance market.

I’ve lost a lot of weight recently—should I apply for life insurance?

Definitely get an instant quote to see your options—you may find there is an opportunity to get well-priced coverage or profitably replace the coverage you currently have. If you have lost a meaningful amount of weight very recently, i.e. in the last 12 months, be aware that most carriers will give you “half credit,” meaning if you’ve lost 50 pounds in the past year, carriers will call that a 25 pound weight loss versus your starting weight. Once you’ve shown stability in your weight for about 12 months, you get full credit for the weight loss.

How does diet impact my insurance application?

Good news: your eating habits will almost certainly not hurt your life insurance pricing. If you have other health issues, i.e. high cholesterol, that can be a problem, but the eating habits by themselves rarely matter.

One instance in which diet can matter a lot is when someone has had a major health event in their past. Demonstrating a commitment to daily exercise and a healthy diet after a heart attack can clinch meaningfully better pricing from the right carrier.

Should I wait to apply until I’m a weight that would qualify me for better rates?

No, this is usually a really bad idea. There are many risks to waiting:

- You die uninsured and your loved ones suffer financial hardship on top of emotional hardship because you were focused on optimizing the details, instead of eliminating disastrous scenarios. This is a classic “letting the perfect be the enemy of the good” situation.

- You lose the weight but another health matter crops up in the meantime (one melanoma will do a lot more to increase your life insurance pricing than an extra 30 pounds).

- You don’t achieve your weight loss goals, and life insurance pricing goes up with age, so the waiting puts you at a disadvantage.

Instead, get your Minimum Acceptable Coverage in place, take the “disaster scenarios” off the table, and remember the opportunity to improve on your existing coverage is always available to you.

Your need for life insurance and your peak commitment to personal fitness and healthy eating often do not coincide. Having people who depend on us can have the side effect of leaving less time for self-care. That is OK. Be kind to yourself and take pride in making a smart financial decision.

The Best Path Forward

It’s always good to get a quote (it’s free and easy) to understand your options.

Your weight is only one aspect of the profile we’ll present in your life insurance application. AboveBoard life insurance concierges are here to help you think through your options and strike the right balance of protection and budget goals.