This is a tale of a financially-savvy hedge fund investor (me) who, despite having a deep understanding of the insurance industry, was completely taken aback by how difficult and frustrating the consumer experience was. The more I navigated the process as a customer myself, the more I encountered misinformation and misleading sales tactics.

That's why I decided to start AboveBoard Financial: a client-focused, relentlessly honest answer to traditional profit-driven insurance brokerage. Our insurance experts go to bat to get you the best possible coverage and pricing options—even when it means more work and less profit for us in the near term. Our goal is to earn your trust and be so delightful to work with that you refer us wholeheartedly to family and friends.

Traditional Insurance Brokerage is Broken

When I first went looking for life insurance, I was expecting my first child and working as a hedge fund investor in financial institutions at Goldman Sachs.

I was an expert in the insurance industry's inner workings, yet I was struck by how miserable it was to navigate as a consumer.BS sales lines and doublespeak abounded. There was no transparency or thoughtful advice to be had. And there was zero client advocacy.

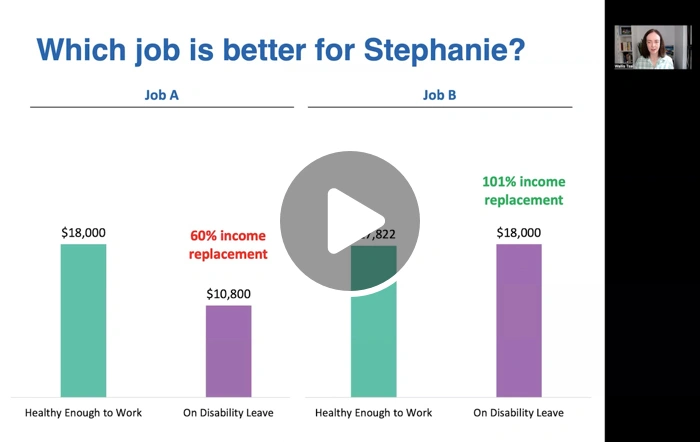

The agent who should have been working to get me the best coverage and price options was obviously only concerned about making his commission and moving on. When the carrier I applied to jacked up the price on me, the agent basically shrugged his shoulders and told me to take it or leave it (insider tip: worse pricing for me directly translated to a bigger commission for him). When I wanted to negotiate with the carrier, I had to contact the company myself. Long story short: it worked. I got upgraded to better pricing. And my so-called agent was not happy.

After this experience, I was appalled, and I knew there had to be a better way.

AboveBoard Does Insurance Differently

I couldn’t find any insurance brokerages offering a better way, so I decided to build it myself, and thus AboveBoard was born. We are relentlessly analytical, ethical, and transparent. We are committed to achieving the best outcomes possible for our clients.

Don’t just take our word for it—check out some real life client stories below.

Helping Clients Save

Caroline had a red flag in her health history that she had forgotten about and her first application was going to cost her more than twice what she budgeted. We searched multiple carriers until we found a carrier who would insure her and keep within her budget. It took more time and effort from our team, not to mention cut our earnings in half, but we are committed to doing right by the client 100% of the time. Learn more.

Helping “Hard to Insure” Clients Get Covered

John had both past DUIs and unexpected medical findings, but we found him affordable coverage. By putting John’s driving history in the context of his current lifestyle and working with the carrier to clear up concerns about his health, we were able to get John covered and save him 40% from the initially offered pricing. Learn more.

If you have loved ones who depend on the income you earn or care you provide, our interactive life insurance guide will help you figure out the right life insurance coverage amount for you. All you need to do is answer a few easy questions, and you'll get personalized advice and unprecedented transparency.